About Us

.jpg)

For more than 75 years, people across Kentucky have put their trust in Kentucky Farm Bureau Insurance. Today, our company protects more than 462,000 Kentucky families and businesses with our top-ranked insurance products.

We employ approximately 700 people across the state of Kentucky, and our State Office is located in Louisville. We’ve also got agency offices in all 120 counties of Kentucky.

At Kentucky Farm Bureau, there are endless ways to unlock your career potential. No matter your expertise, we’ve got a position that’s right for you.

Want to see KFB’s workplace culture in action? Click here to follow us on LinkedIn.

We have opportunities in eight different areas at the state office. Explore the drop-down menus below for more information.

The 120: Bourbon County

When you close your eyes and envision quintessential Kentucky, what comes to mind? You may imagine horses grazing next to split-rail fences, old wooden barns, or charming historic downtowns. Each of these idyllic scenes come to life in Bourbon County, the embodiment of the Bluegrass Region.

When you close your eyes and envision quintessential Kentucky, what comes to mind? You may imagine horses grazing next to split-rail fences, old wooden barns, or charming historic downtowns. Each of these idyllic scenes come to life in Bourbon County, the embodiment of the Bluegrass Region.

Hopewell was the original county seat, but it was renamed to Paris in 1790 as an homage to France for their alliance during the American Revolutionary War (the 20-foot-tall Eiffel Tower replica on Main Street serves as a nod to the town’s origins). Paris’s historic downtown district is filled with ornate architecture and buildings that date back to the 1700s.

Fuel up with some coffee from one of several local spots (try Caffe Marco, Happy People Coffee Company, Hopewell Bake Exchange, or Lil’s Coffee House) while you peruse the Main Street shops, such as Bourbon Boot Supply, Loch Lea Antiques, Quillin Leather & Tack, Southern Lux Style, and more. If you work up an appetite, grab some Asian fusion from Paradise Café (located in the tallest three-story building in the world, according to Ripley’s Believe It or Not) or enjoy a classic Kentucky hot brown in a restored 1882 train station at Trackside at the Depot. For dessert, grab a banana split or a hand-dipped shake from The Rock Café.

Stop in for a tour of the town’s oldest standing building, Duncan Tavern, which was built in 1788. Constructed of local limestone, this landmark often served as a gathering spot for early pioneers, including Daniel Boone. The opulent details of the Bourbon County Courthouse (completed in 1905) are a must-see for anyone interested in historical architecture. Bourbon County is also home to one of the oldest churches in Kentucky, Cane Ridge Meeting House, and one of the last remaining covered bridges in Kentucky, the Colville Covered Bridge. The bridge, which has undergone extensive restoration, is one of 11 covered bridges remaining in the state and one of the few that can still be driven through. At one time, there were dozens of covered bridges spanning Bourbon County streams. This is the last one left in the county.

Outside the city, Bourbon County’s rolling hills serve as the gorgeous backdrop for the Thoroughbred Capital of the World. Guests can tour many of the prestigious farms known for training renowned racehorses. Visit the final resting place of horse racing legend Secretariat at Claiborne Farm, learn all about breeding champions at the oldest continuously operated thoroughbred farm in Kentucky, Runnymede Farm, or see filming locations from the movie Seabiscuit at Hill ‘n’ Dale Farms at Xalapa.

Speaking of the big screen, Bourbon County is home to a rare slice of yesteryear, the Bourbon Drive-In. This family-owned theater has been in operation since 1956, and double features still fill the screens from spring to fall each year. If you decide to catch a flick, keep in mind that the box office is cash only.

While you are in the area, be sure to visit one of the Kentucky Farm Bureau Certified Farm Markets. Enjoy a farm-to-table dinner at Hatmaker Homestead, stock up on farm-raised meat and fresh produce at Pope Family Farms, or pick some apples and unleash your inner kid on the jumbo jumpers at Stepping Stone Farm.

Hometown agents. Because personal service still matters.

For your convenience, Kentucky Farm Bureau Insurance has multiple offices located in Bourbon County. Click here for more information.

The 120 is a blog produced by Kentucky Farm Bureau highlighting each of Kentucky's 120 counties—because we're well-known for knowing Kentucky well.

Tips for spooky safe trick-or-treating

.jpg)

Everyone loves a good scare on Halloween, but not when it involves the safety of our little ones. Before hitting the streets for trick-or-treating, go over these ghoulishly good tips with your little goblin(s):

Costumes

- Plan costumes that are bright and reflective. If your child’s costume is hard to see in the dark, adhere some reflective tape to clothing or trick-or-treat bags for greater visibility.

- Are your child’s shoes too big? Does their costume drag the ground? To prevent tripping, make sure that costumes fit properly.

- Consider decorative hats or non-toxic makeup in place of masks, which can limit or block eyesight.

- Make sure that all costumes and accessories, including wigs, are fire-resistant.

Home safety

- To keep homes safe for visiting trick-or-treaters, remove any tripping hazards from the yard, such as garden hoses, lawn décor, or bikes. Ensure that wet leaves are removed from sidewalks, as they could become slippery.

- Turn on porch or other outdoor lights.

- Keep pets away from the festivities. According to the Humane Society of the U.S., masks and costumes can change how people look and smell to a pet, so even familiar people may become frightening to them.

Road safety

- According to Safe Kids Worldwide, twice as many child pedestrians are killed while walking on Halloween compared to other days of the year. Motorists should exercise extreme caution, drive slowly, and enter and exit driveways and alleys carefully.

- The National Safety Council recommends discouraging new, inexperienced drivers from driving around trick-or-treat time. Popular trick-or-treating times are from 5:30 to 9:30 p.m.

- Trick-or-treaters should carry glow sticks or flashlights and travel in a group.

- Walk on sidewalks or paths. If there aren’t any, Safe Kids Worldwide recommends walking facing traffic as far to the side as possible.

Treat time

- Make sure there aren’t any tricks in your kiddo’s loot. Tell your kids not to sneak any treats before they return home. Sort and check treats and throw away any spoiled, unwrapped, or suspicious items.

With these tips in mind, your Halloween is sure to be all treats and no tricks!

>> In Kentucky, there’s so much to live for. Join us in driving distraction-free this Halloween. To learn more about distracted driving’s prevalence in the Bluegrass State, click here.

How to choose a safe car for a new driver

Watching your child drive away for the very first time can spark many emotions all at once: pride that they accomplished this milestone, excitement for the independence they will gain, and absolute terror for the countless things that can go wrong on the road. It brings you back to their first steps, their first day of school, and now their first time driving on their own. Picking a good first vehicle is not only crucial, it could mean the difference between life and death if a crash were to occur.

Kentucky Farm Bureau Insurance wants to help keep Kentuckians safe, and that begins with making sure you and your children are in reliable vehicles before ever even getting out on the road. To help parents and guardians, we have compiled a list of five points, including resources, to consider when car shopping for a new driver.

- Avoid older vehicles. A study from the Journal of Safety Research found that teenage drivers often drive older car models, which are less safe. So, while many parents may be concerned with keeping a low budget for their teen’s first car, it’s important to remember that newer models come standard with many important safety features. Some safety features to look out for when car shopping are Electronic Stability Control (ESC), Autonomous Emergency Braking (AEB), lane assist, and blind spot monitoring. Many of these functions have been offered for several years now but were not required until recently.

- Start them out with a family vehicle. Did you know that young drivers who own vehicles are more likely to speed and participate in reckless driving activities? On the other hand, if the teen is driving a family car, or a vehicle that their parent is the owner of, they are less likely to drive recklessly or do anything that may result in a wreck or property damage. Research from the National Library of Medicine suggests that it may be wise to let teenagers gain experience with a family vehicle before entrusting them with their own.

- Avoid smaller models. A study from the Insurance Institute for Highway Safety (IIHS) and the Highway Loss Data Institute has shown that smaller and lighter vehicles don’t provide as much protection in a crash as bigger ones do. In fact, teens driving smaller cars are more likely to be injured or killed in a crash than those in bigger models due to the lesser weight, small crush zone, and minimal stability that smaller cars tend to have. It is recommended that parents lean more towards a large sedan or small SUV when shopping for their teen’s first car.

- Stay away from vehicles with a higher horsepower. Keep in mind that new drivers are not experts, and getting them a car with high horsepower could encourage speeding and reckless driving. Multiple reports from the National Highway Traffic Safety Association (NHTSA) and the IIHS have provided data showing that teens aged 16-19 have a fatal crash rate per mile driven that is nearly three times that of drivers aged 20 and up. While teens are still new to driving it may be smart to allow them to gain experience with a vehicle that has a lower to average-powered engine. While the fast sports car may be what they want, that might need to be pushed off for a couple of years.

- Research crash test ratings and recalls before making a final decision. Thinking about your teen getting into a crash is the last thing anybody wants to do, but nevertheless, it’s important to put them in a durable car so that if a crash does occur, they are as safe as possible. NHTSA provides a valuable resource with its 5-star safety ratings program and its safety issues & recalls search tool. Finding important safety information has never been easier.

The IIHS and Consumer Reports have joined forces to provide a great resource with their Safe Vehicles for Teens list. All vehicles on the list provide a direct link to informational pages detailing the crashworthiness, tests, and safety features of each vehicle, and includes both used and new cars, with prices ranging from below $7,000 to upwards of $20,000.

Ensuring that your teen driver is in a safe and reliable car is one of the best things that you can do for them as a parent before sending them out onto the road. However, this alone won’t ensure their safety completely. For additional pointers on how to prepare a young driver for the responsibility of being behind the wheel, read our article: Is Your Teen Road Ready? Tips for Coaching a New Driver.

Is your teen road ready? Tips for coaching a new driver

You've spent years making sure your child is protected from all of the dangers of the world, but now it's time for them to get behind the wheel. You may be hesitant to hand over the car keys, and understandably so. Per mile driven, teens are involved in three times as many fatal crashes as all other drivers, according to the Insurance Institute for Highway Safety (IIHS).

Allowing your teenager freedom in the driver's seat should be a slow, gradual process, and we strongly believe that parents can have a positive influence on the effectiveness and safety of teenage driving. Here are nine ways that the IIHS recommends parents can help keep their teen drivers safe behind the wheel:

- Don’t rely solely on driver education courses. The training offered by driver’s education instructors is extremely valuable for learning the way an automobile should be operated, but it cannot be relied upon as the sole way to produce safe drivers. Teenagers’ tendencies to seek thrills and take risks may lead to poor decision-making when they are behind the wheel of a car. Parents must be involved in the driver training process and share their own wisdom and experiences so that their children recognize what is truly at risk whenever pulling out into traffic.

- Know the law. Parents need to know not only general driving laws, but also the additional restrictions placed on young drivers – then parents need to do their part in enforcing them. For a quick look at the regulations in place for teen drivers by state, click here. For the Kentucky Transportation Cabinet’s summary of the state’s graduated licensing law, click here.

- Restrict night driving. According to IIHS research, the greatest number of teen drivers’ fatal crashes occurs between 9 p.m. and midnight. As most teen driving that occurs during this time of day is recreational, many more distractions are typically present.

- Restrict passengers. Multiple teens riding in a vehicle together with another teenager behind the wheel is often problematic and can result in the temptation to exhibit riskier driving behaviors than usual. The IIHS’s studies have shown that the presence of passengers increases crash risk among teenage drivers but decreases crash risk among drivers ages 30 and older.

- Supervise practice driving. Parents need to be involved in the driver training process and supervise a variety of situations as teens learn to drive. As teen drivers increase their skills, parents should offer them supervised opportunities to drive at night, in heavy traffic or on the highway – not leave these more difficult situations to be solely taught by others.

- Remember that you’re a role model. Children of all ages watch their parents to learn from the example set before them, and teens do much of the same when it comes to developing driving habits. Parents who want teens to drive safely must first set a good example and drive safely themselves.

- Require safety belt use. Even if teens regularly buckle up when riding or driving in a car with parents, don’t assume that the same thing occurs when they drive alone or when they are out with friends. Insist that teen drivers wear seat belts at all times.

- Prohibit driving after drinking. It must be clearly communicated that it is both illegal and extremely dangerous for teenagers to drive after drinking alcohol or using any other drugs. Even small amounts of alcohol are impairing to teenagers.

- Choose vehicles with safety, not image, in mind. While many teens dream of owning a sports car with flashy finishes for their first vehicle, parents should think first about safety and shy away from models that might encourage riskier driving habits. In the event of a collision, ensuring new or young drivers are in a vehicle with capable safety features is far more important than what a car or truck looks like.

This is not an exhaustive list of recommendations, but the common theme among them all is parental involvement. While accidents can occur at any time and for any number of reasons, Kentucky Farm Bureau Insurance encourages parents of teens to take the steps necessary to help teens be safety conscious whenever they sit in the driver’s seat.

9 tips for avoiding a deer collision this fall

Bears, wolves, sharks, snakes, and alligators all probably make the cut when rattling off a list of the nation’s most intimidating animals, but did you know the deadliest animal in the U.S. is actually the white-tailed deer? Each year, this native species is the cause of well over 100 driving deaths in the U.S., according to the Insurance Institute for Highway Safety (IIHS).

November boasts, by far, the highest number of these collisions. In fact, you are 3 times more likely to hit a deer in November over August, according to the Highway Loss Data Institute. Statistics regularly reflect that close to half of all collisions with deer take place during the three-month span of October, November, and December.

Kentucky Farm Bureau (KFB) Insurance claims data supports this trend. More than 8,600 deer strike claims were filed with KFB Insurance throughout 2024, totaling over $58 million in damages. Nearly 38% of those claims (3,239 claims valuing over $21 million) were reported from incidents occurring in the last three months of the year. To date, collisions during the month of November 2024 alone totaled next to $10 million. The average claim payout regarding deer strikes in 2024 was $6,796.

According to a report by the Kentucky Department of Fish and Wildlife Resources for 2024-2025, the estimated white-tailed deer population in the commonwealth is 1,022,977. Statistically speaking, that sets up drivers for a lot of chances to hit one! (Fun fact: Drivers are least likely to hit a deer in the state of Hawaii, where the odds are just 1 in 18,955.)

As migration and mating season comes to a peak, KFB Insurance advises travelers to drive defensively, especially in wooded areas and at dusk. Here are some ways to avoid a deer-induced disaster this season:

- Be particularly alert right around sunrise and between sunset and midnight, when deer are especially active. According to the KSP, almost 50% of deer collisions happen between 5 p.m. and 11 p.m., with the 6 p.m. hour seeing more collisions than any other single hour.

- If you see a deer, slow down immediately! Firmly apply your brakes but continue to drive in a straight line. A swerving vehicle can confuse the animal and prevent it from picking a direction to flee. According to the IIHS, most deaths in collisions with deer occur in subsequent events when a vehicle runs off the road or a motorcyclist falls off the bike.

- Drive with caution when moving through deer-crossing zones and in areas where roads divide farm fields from forestland. Deer crossing signs are posted to alert drivers that certain stretches of road are commonly populated with deer.

- If you see a deer, expect there to be others. Deer travel in herds.

- At night, use high beams whenever possible. They better illuminate the eyes of deer on or near the roadway.

- Do not depend on deer whistles, deer fences or reflectors. These devices have not been proven to reduce collisions. The III recommends one long horn blast to frighten the deer away.

- Always wear a seat belt. The KSP reports that most people injured or killed in automobile collisions with deer are not wearing seat belts.

- If you do hit a deer, do not touch the animal! The deer, in attempting to move or get away, could hurt you or itself.

- Check your coverage! Many insurance companies do not cover deer strikes under collision coverage. Those insured by Kentucky Farm Bureau need to have Other than Collision to cover “contact with a pedestrian, animal or bird.”

>> We want you to be safe out there on the road… but accidents still happen.

At Kentucky Farm Bureau, we’ve got agents in all 120 counties. Click to find one near you.

Hot topic: Fire safety is always in season

Kentucky Farm Bureau (KFB) Insurance takes the personal health and safety of Kentuckians very seriously. Our staff and agents know that fires in the home and on the farm can produce devastating results. We encourage Kentuckians to take a few extra precautions to keep themselves, their loved ones, and their property safe from home and farm fires.

Between 2018 and 2022, KFB Insurance paid out more than $271 million in insurance claims to policyholders reporting fire damage. More than 2,700 homeowners and 2,200 farm owners were impacted by the destruction of a fire on their personal property – which amounts to an average of about 83 total claims filed every month. While KFB agents and adjusters find that partial property losses are more common than total structural losses, after working with policyholders who have experienced fire loss on their property, they would also share that even small fires can produce hefty damage. KFB homeowners lost an average of $68,371 while farm-owners lost an average of $40,881 per claim.

More alarming than the financial impact of a fire in the home and on the farm is when a life is lost under those circumstances. According to the U.S. Fire Administration, 45 Kentuckians died in home fires in 2023.

Most home fires (and most injuries related to home fires) begin in the kitchen. The most dangerous time for a fire to occur in the home, however, is at night. About half of all fire fatalities in the home occur when people are asleep, according to the National Fire Protection Association. Taking a few extra moments to prepare for the worst can increase response times to a fire and, more importantly, help save a life.

A few fire safety tips to remember:

- Every level of a house should have a smoke detector, but they should also be positioned in the space directly outside of sleeping areas and inside each bedroom. Kitchens and other areas where there are high levels of electric usage (rooms with computers and other electronics, such as gaming consoles, for example) need smoke detectors as well.

- A smoke detector is only as effective as its power source. Be sure to test and change batteries often. When working smoke alarms are present, the chance of an occupant dying during a fire is cut in half, according to FEMA.

- Keeping a fire extinguisher in the home and on the farm can prevent small fires from spreading if used properly and quickly. Users should be aware of the types of fires that a home-use extinguisher can address, as not all units are universal in their extinguishing capabilities.

- Make an escape plan and review it with everyone who lives in the house. Slow decision-making in a fire can cost lives; acting quickly to follow a practiced escape plan can save them.

- If a fire does occur, make sure everyone knows where to meet outside and that they go there immediately. A headcount should be made of everyone known to be inside the home when the fire was first noticed.

- Should someone’s clothing catch fire, quickly initiate the “stop, drop, and roll” method to smother the flames.

- Designate one person to call from a cell phone or neighbor’s house to report the fire.

- After escaping a structure on fire, do NOT go back in for any reason. If someone is missing, inform the firefighters so a safe search and rescue can be conducted.

Fires can occur at any time and happen to anyone. While simple awareness and a few precautionary steps can help eliminate many fires from ever starting, a fire can also ignite without anyone’s knowledge or for reasons beyond their control. KFB urges Kentuckians to take the time to prepare their homes, farms and families for the unpredictable and unfortunate circumstance of a fire, because safety is always in season.

>> At Kentucky Farm Bureau, we’re just as invested in your home sweet home as you are. We help protect what’s important to you – from farms and fishing boats to minivans and mobile homes. To see a full list of products we insure, click here.

Kentucky Cattle Auction Report - September 16, 2025

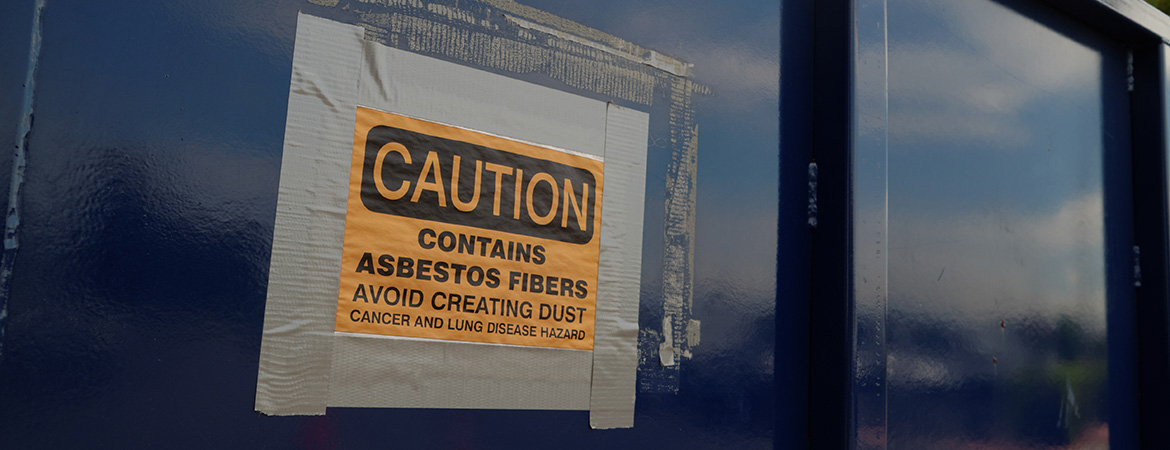

4 things you need to know about asbestos in homes

Do you live in a home that was built before 1980? There’s a good chance it was built with materials containing asbestos. Although the use of asbestos has been regulated by government agencies since the 1970s, it still exists in many homes across the U.S., according to the Mesothelioma Cancer Alliance (MCA). In fact, this harmful substance is still present in a whopping 80 percent of houses built before the 1980s.

- What is asbestos, and why is it in some homes?

Asbestos is a mineral fiber that naturally occurs in rock and soil, according to the Environmental Protection Agency (EPA). Due to its sturdy properties, it was once used in a wide range of building materials; but by the 1960s, scientists had discovered asbestos’ link to lung cancer, and the substance became heavily regulated by the EPA in the 1970s.

Asbestos may be found in:

- Insulation

- Floor, ceiling, and wall tiles

- Roofing and siding shingles

- Textured paint and patching compounds

- Pipe coating

- Heat-resistant fabrics

- Walls and floors around wood-burning stoves

That’s not all! Curious where else asbestos may be hiding in your home? Click here for an infographic from the MCA.

2. How does exposure occur?

Asbestos products are typically not dangerous if left unbroken or enclosed. For example, bathroom tiles containing asbestos aren’t a risk in their intact, encapsulated state. It is only when asbestos products are disturbed or damaged in some way that they present a health hazard. This is because asbestos is a “friable” material, which means it easily crumbles into tiny particles that can become airborne. The fibers may be released into the air by the disturbance of asbestos-containing material during home maintenance, repair, demolition, or remodeling.

3. What makes asbestos dangerous?

Exposure from inhaling asbestos fibers can result in the development of lung cancer, mesothelioma (a rare form of cancer in the lining of the lung, chest, abdomen, and heart), and asbestosis (a progressive and long-term inflammatory lung disease). After initial exposure, symptoms can take a decade or more to develop, according to the American Cancer Society (ACS).

4. How should you deal with asbestos?

Just because asbestos is in your home does not necessarily mean that it needs to be removed, according to the ACS. An expert can test your home for the substance and determine if it poses any risk of exposure. Should materials need to be removed, licensed asbestos abatement professionals are trained to carefully remove and dispose of the threat without further contamination. Kentucky has laws in place to keep our state’s air free of asbestos and other harmful toxins, so do not attempt to remove asbestos-containing material yourself. Abatement professionals should be certified by the Kentucky Division for Air Quality and knowledgeable about the laws pertaining to asbestos removal in the Bluegrass State.

Despite decades of regulations, thousands of people are still dying of asbestos-related cancer each year. Proper education and prevention can help keep you and your family safe from this inconspicuous carcinogen.

>> At Kentucky Farm Bureau, we’re just as invested in your home as you are. We help protect what’s important to you – from farms and fishing boats to minivans and mobile homes. To see a full list of products we insure, click here.

Trees, leaves and debris: Your gutters' worst enemies

As the days become shorter and the nights become cooler, the first of nature’s cold-weather villains come into play: leaves. Many homes in Kentucky are surrounded by trees that begin to burst with fiery color in autumn. However, pretty foliage can quickly turn ugly when it falls from trees and starts to call your gutters home.

Gutters play a vital part in protecting your home by diverting thousands of gallons of water from the roof, exterior, and foundation. When gutters become blocked and this water has nowhere to go, it can wreak havoc and potentially cause thousands of dollars in damage to your residence… and your wallet.

Imagine walking in after a heavy rain to find your basement flooded–electronics ruined and furniture soaked. Water gathering around the base of your home can slowly erode and weaken the foundation, eventually causing cracks and leaks, and, in the worst-case scenario, collapsing.

Clogged gutters can also retain water, allowing it to pool on the edge of the roof and seep under shingles and into the plywood below. This trapped moisture can cause roof rot, allowing water to enter your attic and the rest of your home.

When water seeps into the walls of a house, mold also becomes a very serious threat. According to the Centers for Disease Control (CDC), mold can cause adverse health effects, including nasal stuffiness, throat irritation, coughing, wheezing, eye irritation, and even serious lung infections.

If you find mold in your home, you can remove it from hard surfaces using simple household cleaners and non-porous gloves. However, if the area to be cleaned is larger than 10 square feet, the CDC recommends hiring a professional to inspect the problem, which can quickly produce a bill in the thousands of dollars.

Another side effect of blocked gutters is unwanted house guests. The soft leaves, pine needles, saplings, and debris in your gutters are perfect home-building materials for invasive critters such as squirrels, possums, birds, and cockroaches. According to a study by the University of Kentucky College of Agriculture, Food and Environment, standing water in packed gutters can also produce hundreds of mosquitoes in just a few days.

In many cases, prevention is a much cheaper (and easier) option than repair. Luckily, you have the opportunity to clean out your gutters before they clean out your bank account. Preventing most of these problems is as simple as removing debris a minimum of twice a year (once in the spring and once in the fall, generally). Another option is gutter guards, which were created to help keep your gutters free of debris if installed and maintained properly.

Protecting your home from Mother Nature can sometimes seem like a wild card. Unfortunately, you can't control the weather. Fortunately, you can control how protected your home is against it.

>> At Kentucky Farm Bureau, we’re just as invested in your home as you are. We protect what’s important to you – from farms and fishing boats to minivans and mobile homes. To see a full list of products we insure, click here.

Weekly Economic Report - September 15, 2025

About Us

OFFICERS

| President | Chuck Tackett | |

| 1st Vice President | Steven McIntosh | |

| 2nd Vice President | Phillip Howard | |

| Secretary/Treasurer | Steve Schureman | |

| Farm Bureau Women's Chair | Donzetta Hughes | |

| Young Farmer Chair | Chase Gillispie | |

| Generation Bridge Chair | Daniel Smith |

DIRECTORS

| Clint Bevins | Frankfort | |

| Chase Gillispie | Sadieville | |

| Dale Glass | Georgetown | |

| James Happy | Georgetown | |

| Ted Holland | Georgetown | |

| Phillip Howard | Stamping Ground | |

| Stewart Hughes | Georgetown | |

| Rita Jones | Georgetown | |

| Alvin Lyons | Georgetown | |

| Steve McIntosh | Georgetown | |

| Chuck Olver | Georgetown | |

| Roger Quarles | Georgetown | |

| John Ruber | Georgetown | |

| Beckham Sharpe | Georgetown | |

| Daniel Smith | Stamping Ground | |

| Stephen Smith | Georgetown | |

| Chuck Tackett | Georgetown |

Calendar Of Events

Kentucky Cattle Auction Report - September 9, 2025

Weekly Economic Report - September 8, 2025

Kentucky Tobacco, Still a Tradition for Growers

Although the crop is significantly smaller than it was 30 years ago, it still holds a place on Kentucky's agricultural map.

In 1994, Kentucky tobacco producers grew 187,000 acres of tobacco, weighing in at over 453 million pounds and worth nearly $841 million. That was 10 years before the Fair and Equitable Tobacco Reform Act eliminated an antiquated tobacco quota system that had been in place since 1938.

In stark contrast, the 2024 Kentucky tobacco crop consisted of 32,800 acres, and fetched over 75 million pounds, worth nearly $200 million, which was exponentially smaller as market trends have changed in the past three decades.

Luckily, Master Settlement dollars have helped to diversify the state's agricultural landscape thanks to the Kentucky Agricultural Development Fund helping to sustain the family farms once so dependent on their tobacco crops.

But for those still in the business of raising crops, today it is as much about tradition as it is dollars and cents.

Kentucky Farm Bureau Second Vice President Larry Clark grew up on his family's farm in the small community of Exie in Green County, a place where tobacco crops can still be found and the tradition of growing it remains.

“We grew up with the tobacco and dad always taught us to have pride in it, the way we grew it, the way we shipped it, and the way we presented it at the market,” he said. “I think that caused us to have it in our blood, and it is a tradition that we carry on.”

Clark recalls the days of selling a crop at the many tobacco warehouses that could be found throughout the state.

“We did have a system where each farm had so much of a quota on it, and it fluctuated up and down according to the demand for the tobacco,” he said. “In the early 2000s, that quota system went away and was replaced by a contract system, and it's been a lot different ever since.”

No longer were growers subjected to a federal regulatory system, but rather to direct contracts with tobacco companies. Many producers opted for the quota buyout that came along in 2004. That, along with changing market trends, led to the decline in tobacco production.

“When I was growing up, we hand-tied the tobacco and tried to have the stripping finished by Thanksgiving," he said. "Then, we would load the crop onto wagons, haul it to the markets, and spend a day placing the tobacco in baskets, making it look good. In a week or two, we’d go back and watch the buyers follow the auctioneer as he chanted, taking bids. It’s something I’ll never forget. I loved it. Now, we have to go by whatever the companies are willing to pay."

Like so many other farms that depended heavily on a tobacco crop, Clark has diversified his operation today, which consists of cattle, grains, and hemp, to go along with his 218 acres of burley.

“I think the relationships growers have with the tobacco companies are vital to our continuing in the tobacco business, especially for the younger generation," he said. "But we have diversified our farm so our two sons will have the opportunity to continue farming whether they continue to grow tobacco or not."

As with many other crops, tobacco has seen a challenging growing season, especially with all of the spring rains, a time when most producers are setting their tobacco plants.

“It's been very challenging this year, since we've had more water this spring than I can ever remember us having,” Clark said. “The ground was too wet when we planted some of the crop, and you pay for that later in the year. Tobacco doesn't like wet feet! We're going to have a decent crop in places, but in other places we're not.”

Bob Pearce, a burley tobacco specialist and extension professor at the University of Kentucky Martin-Gatton College of Agriculture, Food, and Environment, echoed what Clark said about tobacco crop conditions.

“There are some crops that look really good, and there are some that are really struggling. We had a fair amount that either got planted late or, in some cases, maybe didn't get planted at all because of the weather, so it's all over the place this year.”

Many of the rains that have come this year have been localized, which has led to the good crop here, not so good there, kind of scenario.

“That's some of the reasons we're seeing the spottiness of this crop in some places that did well and other places that didn't, because we've had some rains that have been very localized and sporadic in some cases,” Pearce said.

By press time, much of the state's tobacco crop, good or otherwise, will have been harvested and hanging in barns to cure.

Clark said he loves the smell of the tobacco in the barn, something he remembers from childhood.

"I've lived in this area all my life, and the fourth generation of my family to do so,” he said. “We will continue to farm here and raise tobacco, because that's what we do, it's a family tradition," he said.

President's Column | Ham, Heart, and Heritage, a Good Way to Describe KFB this Time of Year

I’m a firm believer in the good our organization does for this state and our agriculture industry every day of the year. I say it because I believe in it, I have lived it, and I see the fruits of our labor from the front porches of our farmhouses to the Capitol steps in Washington, D.C.

I was reminded of this as I looked out over the crowd during our recent KFB Country Ham Breakfast and Charity Auction, seeing so many familiar faces: people I’ve known for years, people I’ve been proud to work and serve with, people who make up the heart of our organization, KFB leaders and county members.

It was an honor to mention them first during my breakfast remarks. They truly are the foundation of this organization. Never doubt it.

In continuing my remarks, I also realized what a tradition we carry on with this event, and so many others that are a part of our heritage. We’ve lasted nearly 106 years and throughout we have forged a path that has led us to being a strong and true voice of agriculture.

And of course, there’s the ham. Who knew 61 years ago, a champion country ham would serve as the vehicle to drive us to such heights in helping people throughout Kentucky. We are truly blessed to have so many businesses and entrepreneurs who show up every year to keep this tradition alive and well.

I say all that to say this: it is often good to reflect on positive events and successful outcomes to issues, but we also have to continue our advocacy efforts to ensure we move forward on those issues that present challenges on the farm and in our rural communities.

As we get closer to our Resolutions Committee meeting and the next annual meeting coming later in the year, our local and state leaders will be doing just that…looking at ways to make our industry and rural communities better.

This process of moving suggestions from the local level up, is a part of the heritage that began more than a century ago and keeps our organization relevant and successful. Make no mistake about it, KFB has a seat at the table when it comes to discussions that affect our farm families.

This is a busy time of year, on and off the farm, but one we embrace as farmers, as community leaders, and as Farm Bureau members. We welcome the harvest, as well as the upcoming advocacy opportunities that are as much of a tradition as that champion country ham.

Eddie Melton, President

Kentucky Farm Bureau

Tradition Meets Generosity | Kentucky Farm Bureau's Ham Breakfast Raises $10M at State Fair

Political leaders, policy makers, and county members make up a capacity crowd to witness another history-making event.

The 61st Annual Kentucky Farm Bureau (KFB) Country Ham Breakfast and Charity Auction at the Kentucky State Fair brought in a combined winning bid of $10 million in support of Kentucky charities, continuing the longstanding tradition of generosity that has made this event one of the commonwealth’s most anticipated gatherings.

Since its inception in 1964, the breakfast has raised nearly $54 million for nonprofit organizations and other charities across Kentucky; $30.5 million in the last three years, alone, thanks to the combined efforts of Central Bank and Joe and Kelly Craft.

Once again, these two top bidders joined together to come up with this year’s winning total.

Central Bank’s President & CEO, Luther Deaton, said that giving back to the community is something the bank has done since its inception.

“Mr. Garvice Kincaid started this bank in 1946, and he always said, ‘We're going to give back to the communities and we'll take care of the children, and we're going to fund education,’ and that's what we do,” Deaton said. “God has blessed me with so many good relationships, and Joe (Craft) and I have a great relationship, and it's just an honor to be partner with him and our bank to do this. This event is about more than a winning bid — it’s about making a lasting impact. Our team is proud to give back to charities that strengthen communities and provide hope for Kentuckians across the state.”

While the Crafts were away and unable to attend, Jennifer Barber, Partner-in-Charge of Frost Brown Todd's Louisville office, placed the winning bid on their behalf.

“I've been to the ham breakfast many times, and this is a very important event for Kentucky,” she said. “Kelly and Joe Craft would like to thank Kentucky Farm Bureau for hosting this wonderful event again this year. They hope their charitable contributions will help improve the lives of Kentuckians across the Commonwealth. It's a real honor for me to be here to bid on the ham for them.”

Remarks from KFB President

KFB President Eddie Melton thanked all of this year’s bidders with a special shout-out to Central Bank’s Deaton and the Crafts. The combination of their separate bids of $5 million helped push the winning bid to a near record level once again for the State Fair’s Grand Champion country ham.

“While our name is synonymous with the Ham Breakfast every year, it is the charities our bidders support that are really the winners, at the end of the day,” he said. “I’m incredibly thankful for our businesses and entrepreneurs who have made this event a tradition of their own.”

Melton addressed the crowd of over 1,600 before the auction took place, beginning his remarks with thanks to the county Farm Bureau members and leaders in the room, and across the state.

“Our organization can’t do all the great things we do without the continued support of every member in every community throughout Kentucky,” he said. “They truly serve as the foundation of KFB, and we can never thank them enough.”

Specifically, Melton mentioned the efforts county members made in the past year in giving out a record amount of scholarship money to deserving students.

“A prime example of our members’ community involvement is the scholarship programs offered by county Farm Bureaus throughout the state,” he said. “Helping with educational endeavors is one of KFB’s top priorities. This year, a total of 601 state and county scholarships were awarded, worth $810,150, a new record for this program.”

Melton also recognized the work Lt. Governor Jacquline Coleman and Agriculture Commissioner Jonathan Shell are doing in getting ag education to elementary students across the state.

From a policy perspective, Melton mentioned the efforts being made, at all levels, to move KFB’s Kentucky Farmland Transition Initiative (KFTI) forward.

“Legislatively, House Bill 703 was introduced by State Representative Myron Dossett to make changes to the Kentucky Selling Farmer Tax Credit, making the credit work for more farmers and providing greater certainty for sellers,” he said. “Provisions of this bill were included in HB 775.”

In addition, Melton talked about the contribution Kentucky U.S. Senator Mitch McConnell made to farmland transition with the introduction of the Protecting American Farmlands Act.

“Sections of that bill were included in the recently signed reconciliation bill,” he told the crowd. “We were able to work with Senator McConnell to establish the first-ever provision in the federal tax code to provide some relief on capital gains taxes for sales of land that stays in farming.”

McConnell received a special welcome and recognition for his long support of agriculture and the many years he has devoted to the Commonwealth as he prepares to leave his Senate seat after his term expires next year.

Melton concluded his remarks with a call to get the farm bill finished.

“While we appreciate the support of agriculture in the recent reconciliation bill, let’s finish this work by passing a new farm bill,” he said. “Together, the two will update programs and add certainty for farm families as they continue to produce our nation’s food supply. Food security is national security.”

Candid Conversation | USDA Deputy Secretary Stephen Vaden

Candid Conversation presents a question-and-answer discussion about the topical issues related to Kentucky Farm Bureau (KFB) priorities, the agricultural industry, and rural communities. In an exclusive interview, USDA Deputy Secretary Stephen Vaden discusses the issues and opportunities facing the ag industry as he settles into his new role. Vaden's family has a long historic presence in far western Kentucky and his home state of Tennessee. He owns two farms, one in each state just miles apart. On July 8, he was sworn in as the new USDA Deputy Secretary.

KFB: Would you share with our readers a little of the background of your Kentucky farm?

SV: The farm in Fulton County, Kentucky is the oldest one that we own and it actually dates back to before the Kentucky State Legislature formally established it as a county. We have the original plaque of the county when it was established, and my ancestor owned this farm in exactly its current dimensions. Now, here we are nearly two centuries later, and the same family still owns the same land. So, I'm immensely proud of that.”

KFB: So often we see a storied history connected to our farm families. How does it feel to have that kind of heritage associated with the farm?

SV: Agriculture really is a family. And if you talk to anyone else who's involved (in the industry), just the fact that you share that common set of values, that common way of making a living, you know what that person is going through, whether it be good or bad, and you can commiserate. That is so important, the family nature of agriculture, that honestly, when we meet, we're not necessarily looking to compete, we're looking for ways to help each other out so that we can all succeed. And that's what makes agriculture so special.

KFB: Farm life has always traditionally had its share of trials and triumphs, there's lots going on, especially today. What are some of the more challenging issues you see facing our farm families today?

SV: Well, obviously the first issue is the low commodity prices and the high cost of production. That is the worst possible combination, and we've got to create more markets for our agricultural goods, whether it be domestic or overseas, because the only thing that is going to cure low commodity prices is more demand. That's what we've got to be focused on at USDA.

KFB: In keeping with the creation of more markets, especially from a trade perspective, we are in the midst of a growing ag trade deficit. What measures can we take to curb that situation knowing it’s not an overnight fix?

SV: It isn't a problem that developed overnight, and it won't be a solution that comes overnight, but what we've got to do is to stop accepting other countries creating barriers to American farmers selling their goods overseas. We've got to have as close as possible a zero-tolerance attitude to anyone who wants to keep an American farmer from selling his or her products to overseas consumers. We know we win because of the quality and the quantity that we produce here in the United States of America, and that's why so many people want to keep our products out of their countries, is because they know they can't compete with us if it's a fair competition.

KFB: Most of the farms that we have in Kentucky, as well as many other states, are smaller family farms. How critical are trade markets are their farms and do you think they fully understand that even the smaller operations have a stake in agricultural trade?

SV: Well, it's really simple. A rising tide lifts all boats. And even if you and your operation may sell only domestically, the prices that you're able to get for your commodities are determined by the total overall demand for those commodities, and that includes international demand for American agricultural goods. If demand is lower, the price you're going to be able to get for those commodities is lower, even if you're only selling domestically. The more people we can get interested in American agricultural products, the higher prices will be, whether you're selling domestically or internationally.

KFB: And we've got some folks in Washington D.C. who are zeroed in on that right now, don't we?

SV: That's right. We've got an entire trade team, and they know, because the President demands, you can't have a trade discussion with the United States unless you're willing to talk about agriculture. And if you're not willing to talk about agriculture, the President isn't interested in making a comprehensive deal with you because you're not being serious.

KFB: We often hear that we grow the safest food supply in the world because of all the regulatory steps required in growing our crops. Yet, some people don't realize that and some are against some of the measures farms take to ensure the success of their crops. What do we say to those naysayers?

SV: If we're talking about a chemical that is used on something that comes from a farm that people eat, it has gone through so many regulatory checks, that it would boggle most people's minds. And you have to keep in mind that the people, the regulators who are doing this, whether we're talking about the Environmental Protection Agency or some other agency, they're not farmers and they're not particularly, to be honest, friendly to ag.

They're looking for anything and everything that could possibly be harmful to say no to whatever it is that's being proposed to be used on a food product. And so if something has gone through that process, the consumer should rest safe in knowing that it is truly safe and they shouldn't give a second thought to it. America has the safest, most efficient agricultural production in the world, and we should be proud of that.

KFB: We often say, "Food security is national security." How do we do a better job of emphasizing to the public that point, especially for all those, not only consumers, but lawmakers who are far removed from the farm, and may not understand how critical is it to keep our farms sustainable today, and for the future?

SV: During President Trump's first term, I served as the USDA representative to something called the Committee on Foreign Investment in the United States. That's the committee that looks at foreign investments in the United States to ensure that there are no national security concerns. Whenever I was dealing with counterparts from other federal agencies, one of the things that I emphasized is, is that if a nation cannot feed itself, nothing else matters. Because the first thing you've got to have in order to have military strength is an army that's fed. So, food security truly is national security.

And I'm happy to see with the debate over foreign ownership of farmland that more people are coming to the understanding that we need to care about who owns our agribusinesses. We need to care about who owns our farmland, and we need to care about whether or not any particular investment in this country could be used to take out of American control and out of American hands our most vital resource, our agriculturally productive land and the technology that we have created to make that land more effective. I'm very optimistic that more people than ever are aware that national security is inextricably tied up with the success of American agriculture.

KFB: Let’s switch gears and talk about getting the next generation coming to the farm. How critical is it to get those younger people involved and what can we do to encourage them to come to or stay on the farm?

SV: In any business, if you want to continue it on, you've got to have a succession plan, and agriculture is no different. We need the next generation to step up. And it is very disturbing how the average age of the American farmer seems to only increase. It seems to me that one of the best things that we can do to get young people involved in agriculture is to make agriculture as productive, profit-wise, as it can be, and right now it's not. And so, you have to have an extra personal drive to be involved in agriculture. We need to work on policies that make agriculture profitable because ultimately, it's that profit that will help draw people to our industry and want to invest in it, want to be a part of it, and want to continue it on for the next generation.

KFB: Farmers have to be the ultimate optimist, and when faced with challenges, often, I they also look for opportunities. What are some of those opportunities that you see for folks on the farm and in the ag industry today?

SV: I'm excited about the fact that some of the adversaries that we may have had in the past are increasingly turned into allies. I think about the biofuels debate, the way the biofuels debate has changed over the last five years is truly astonishing. At one time you had so-called big oil versus ag, and now both of those parties have realized we're not at odds with one another. We're on the same ship because an electric car uses neither oil nor biofuels. And so we can either rise together or we can sink together, but we shouldn't be arguing with one another.

There are so many other issues where that's the case and where people realize that partnering with ag is a value-add for both. And so I think what we've got to do is be open-minded and look out for both traditional and non-traditional alliances because the more people who take an interest in agriculture and come to understand that the way we practice agriculture here in the United States is effective, efficient, environmentally sensitive, and able to feed the world at the least possible price point, there can only be good things that come from that knowledge.

KFB: How important is Farm Bureau and organizations or commodity groups, and all those folks that make up this network of agriculture, this agriculture organizations and industry, how important is that for advocacy purposes, for supportive farmers, just in general?

SV: They're vital because they are the literal grassroots. The members of these organizations, whether it be the Farm Bureau or the commodity organizations, they are the people growing what we eat every day. The concerns that they transmit through their organizations are not made up. They're also the most vital concerns because they're affecting their profit and loss potential and the headaches that they have every day to get their job done. And so it's vital that people participate in these organizations and it's vital that these organizations speak out, like the Farm Bureau. Whenever you have an audience with someone, get straight to the point, and be respectful, but also don't be scared to be blunt and get your message across, because more people need to hear it now more than ever.

Miss Kentucky 2025 | From Foster Care to Fairytale

Ariana Rodriguez shares an emotional story of her journey to the crown.

The first time I saw Miss Kentucky, Ariana Rodriguez, it was in a photo of her getting crowned as the 2025 winner. She had a look of astonishment on her face; happy—no, ecstatic—and surprised all rolled into one.

The first time I met her, however, it was far from the lights of the pageant stage but rather in front of an old, abandoned house in Muldraugh, Kentucky, a place where she once lived as a middle school-age child.

I couldn't help but think how far life had taken her, from living in that dilapidated old house with no running water and no electricity, to the recognition and accolades that came with being named Miss Kentucky.

Her story is amazing, and she shared much of it with me during a recent Kentucky Farm Bureau (KFB) News podcast. I first asked her how she felt the minute she was named as the new Miss Kentucky.

“I was just completely in shock and didn't believe it,” she said. “In fact, in all of the videos that my friends and family took from the audience or from online, they're saying, ‘She's going to pass out. She's going to pass out,’ because I was just sitting there shaking.”

Rodriguez said it took about a month for the complete acknowledgement of it all to sink in.

“It felt like a dream, and every single day I just woke up and I was like, ‘Is this really happening?’”

In fact, it was, and it is more than a dream, but the road she had to endure to get to this point in her life was often unsettled at best, and heartbreaking, at times.

Rodriguez spent much of her childhood in foster care due to unfortunate family circumstances and would eventually, for a period of time, become homeless.

“I'm the first alumnus of the foster care system to ever win the title of Miss Kentucky,” she said. “When I was five years old, I went into kinship care for the first time, which is similar to foster care except you're placed with relatives or people who knew you before you went into the court system.”

Rodriguez remained in kinship care for eight years and entered foster care at the age of 12.

“I entered foster care because my providers just couldn’t afford to take care of us, but I was separated from my brother and sister, and that was extremely difficult,” she said. “Being in foster care is difficult enough, but when you're separated from the only life you've ever known, and on top of that, you're separated from the only family that you've ever known, it was really difficult for me.”

Rodriguez would exit the foster care system, only to become homeless at 16 years old.

“My mother had a difficult life and was also homeless at 16, so this is a very systemic issue,” she said.

Rodriguez’s mother had turned to drugs in her life but would eventually come clean; however, affording three small children was difficult at best and often impossible.

"It wasn't that my mom and grandma didn't care for us; they just couldn't afford financially to provide for us," she said.

But she had the determination to make her way out of these unfortunate and very difficult life occurrences.

“During my senior year of high school, I knew that I wanted to go to college, and up until that point, I thought that I was eligible for the foster care tuition waiver,” she said. “But I found out that I exited the program about 26 days too early to receive any financial support. Over 14 years in the system, and 26 days too early. It was really hard for me.”

As I listened to her story, I couldn't help but think that a lot of people would have given up at this point. It was one more setback in a long line of setbacks. But I could tell there was something about this young lady that was different from most people. She was determined to make a better life for herself.

“During high school, knowing I wanted to go to college, I began to look online for talent competitions because I love to sing,” Rodriguez said.

That search would lead her to discover the Miss Kentucky organization, which she originally thought was a talent contest. Little did she know she was about to enter the pageant world, and life would take a major turn for her.

“I saw that there was a $20,000 scholarship with the pageant and I signed up that day,” Rodriguez said. “It was the scholarship that initially caught my eye. So, I put all of my college savings into competing in the local preliminary competition, and I lost.”

Feeling as though she had also lost her only chance of getting to college, she soon found mentorship from a host of people who helped her to the next level of the pageant.

“That took me to Miss Kentucky my first year and gave me the leverage to be able to get job positions so that I could pay for it myself the next two years,” Rodriguez said.

It was on the third try that luck came her way, and the rest, as they say, is history. In being a part of this organization, participants have a cause or platform that they present, and because of her life story, bringing attention to the foster care program was an easy choice for her.

“My platform is ‘The Lucky Ones Foundation,’ and it's a nonprofit that I designed during my senior year of high school to educate the public about the issues of the foster care system and amplify the voices of those who've experienced it themselves,” Rodriguez said. “Two of the most prominent initiatives of the foundation include ‘The Suitcase Project’ where we collect suitcases for youth in foster care, and we fill them with essential items that they need when transitioning from home to home, and ‘The Lucky Ones’ podcast, a platform that I designed to educate the public about the issues of the foster care system.”

By the way, her dream of going to college has also come true as she is currently a student at the University of Kentucky and Rodriguez’s family is also doing well and quite proud of her accomplishments, she says.

As with all Miss Kentuckys, Rodriguez became a spokesperson for the Kentucky Department of Agriculture, something that has kept her quite busy, especially with the State Fair having just wrapped up. Now with a very short time to rest, she will be on her way to the Miss America Pageant.

This edition of the Kentucky Farm Bureau News will go to print before we know the results of Miss America, but Ariana Rodriguez is a winner in my book. She counts herself as one of the lucky ones, thus the name of her foundation. But anyone who gets to know her and her story can count themselves as being very lucky, too.

Uncovering Rural Kentuckians' Stories on KFB's 'Let's Get Rural' | Renee Carrico

Let’s Get Rural!

Many times, I am asked what I love most about my job here at Kentucky Farm Bureau, and honestly, the answer is simple: the people. Often, the assumption is that I am talking about our Kentucky farmers. And for the most part that is true. Hey, I’m one of you.

However, as I’ve traveled the state and met not only our active farmers, but also our active Farm Bureau and rural leaders, I find that farmers aren’t the only ones I’m drawn to.

Maybe I’ve spent too much time with KFB News Editor Tim Thornberry, but the stories across this state are fascinating and truly can’t be shared enough. The communications team at KFB is phenomenal in many formats, whether that be print, video, social media, etc. The recent addition of some impressive new technology at our State Office included a podcast room and a couple of microphones begging for regular hosts.

Throw in two chatter boxes like me and KFB Studios Manager Matt Hilton, and you get KFB’s podcast, which was recently rebranded to “Let’s Get Rural.” “Let’s Get Rural” is a podcast covering all things rural Kentucky. This can range from planting and calving season updates to philanthropic activity recaps, to live recordings at a KFB event and local ag education event updates. Visit the new landing page at kyfb.com/federation/lets-get-rural-podcast/ to learn more about the podcast.

So, why a podcast? Well, because this form of digital media continues to grow in popularity for a variety of age groups. As we find ourselves in the truck hauling grain, in the tractor putting out hay, or as the unlucky night shift driver on a family vacation to Florida, many people have moved from a music playlist to audio books and podcasts.

For listeners, podcasts are like an audio-only weekly show that, as time goes on, you begin to feel a connection to the host(s). With that virtual friendship comes trust to give even an episode that doesn’t immediately seem enticing a try.

As hosts, podcasting is an opportunity to not only entertain but also educate and share perspective. With Matt Hilton, the podcast’s “city slicker,” and myself, the “aggie,” we leave no stone unturned and no silly questions unasked.

As much as I hope everyone who reads this will subscribe and listen, I also want to encourage those with great stories to be willing to share them with us. Sometimes people find a video camera to be intimidating, but sitting in a room having a casual conversation is often a less frightening way for our guests to talk about what they do and why they love to do it.

In the end, no matter what area or industry you are in, we all have a passion for something and are just looking for a way to live it out. Podcasting is about sharing that passion. I can’t thank all our current listeners enough and look forward to getting to share more stories in the future. So until then, Let’s Get Rural!